Warren Buffett once stated in his 2004 Bershire Hathaway Chairman’s letter, "Investors should remember that excitement and expenses are their enemies. And if they insist on trying to time their participation in equities, they should try to be fearful when others are greedy and greedy only when others are fearful." zenruption really likes Warren Buffett. He is way, way smarter than us and it is always good to follow the smartest person around.

Right now there is a lot of greed and not a lot of fear going on in the financial markets. It is never a good sign. Markets recovered from a horrible January in spectacular fashion, staging one of the biggest comebacks in stock prices ever. It is fairly unprecedented to see what looks like an amazing addition to the Six Flags rollercoaster line in the stock market, in such a short time frame. In the last year we have seen it twice, August - November and now the January – March period. Honestly, it is a little scary for long term investors. Traders love it, but we regular Joes don’t.

One of the biggest indicators of the amount of greed currently in the markets is in the amount of margin (borrowed money used to purchase securities) in use. Right now the use of margin is at the highest level it has been since 2007. Traders are heavily leveraged at this time and finding more margin will get ever harder. Less margin means it gets harder to keep buying and propping up stock values.

Another pullback in the stock market could further limit the ability of traders to buy as margin calls (the call by the lender to deposit additional money or securities to bring an account to a certain standard) could further limit the ability of traders to purchase any further stocks and thus push prices further down.

The pullback could be reality soon as earnings season kicks off with Alcoa (symbol AA) reporting after the bell on April 11th. Generally, companies are expected to have had lower earnings in the 4th quarter of 2015. Actually it will be the fourth such quarter in a row and the fifth of lower sales. Not good. This hasn’t happened since prior to the 2008 recession.

The crazy thing is that this earnings season is expected but yet we have seen a massive rebound in stocks, partially due to buying on margin. The greed came out to play and it could all be crashing down very soon.

The zenruption team feels strongly that we have made some solid and safe stock picks in the past and that dividend paying stocks will also be a good way to go for us average investors to go.

We regular people don’t have the ability to hedge with portfolio insurance strategies, but we can seek safety and go to cash. Despite the recent run, we at zenruption remain convinced that there is pain in the near future.

Lina Martinez is a contributor to zenruption’s money and life sections. She is committed to helping the average person manage their money and investments, where the big guys seem to take advantage of us all. Lina often thinks about such issues over beer and wings with the zenruption team. She bores us sometimes, but we still like her.

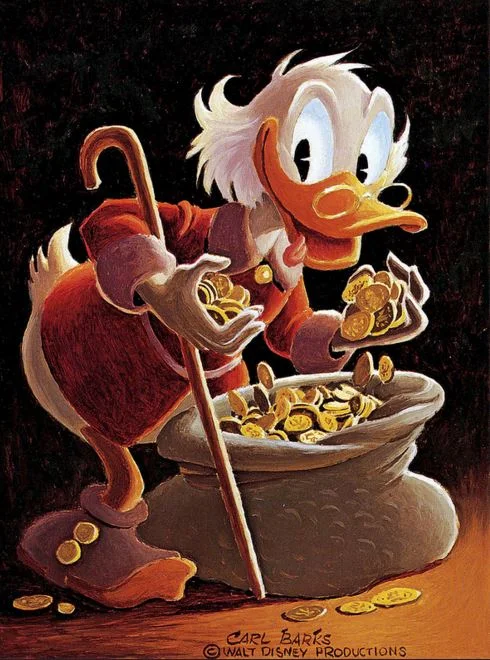

Feature photo courtesy of Flickr, under Creative Commons Attribution-Noncommercial license