For most Americans it is taken for granted that we can open a bank account. Providing proper identification, like a driver’s license or birth certificate is passé. For many people in the third world, however, documentation of their birth isn’t as usual, particularly in rural areas. Imagine being born in a small village in Africa and although everyone in the village knows who you are, institutions, like banks, have no proof you were ever born.

It gets more complicated because you might drive a vehicle, but the village doesn’t emphasize licensing. And if they do, how do you get one with no proof of who you are? These complications make opening a bank account extremely challenging. This is important too, because without a bank account, people are limited to carrying cash. This makes them more vulnerable to robbery. Imagine if all of your money were in cash and in an unsecured location. It restricts financial mobility. Try getting a mortgage without a bank account or verification of your identity.

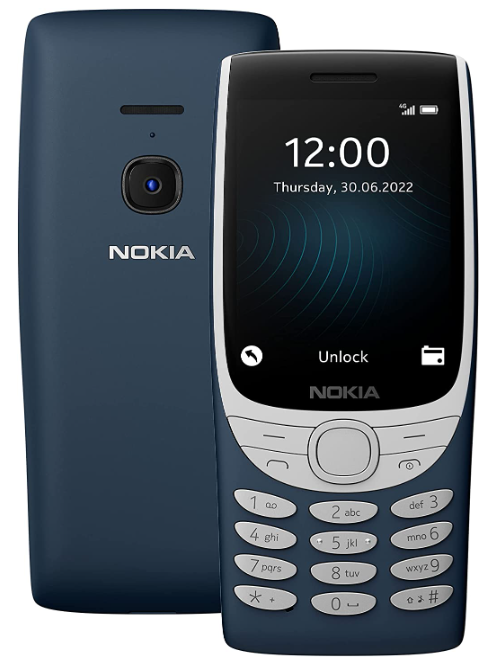

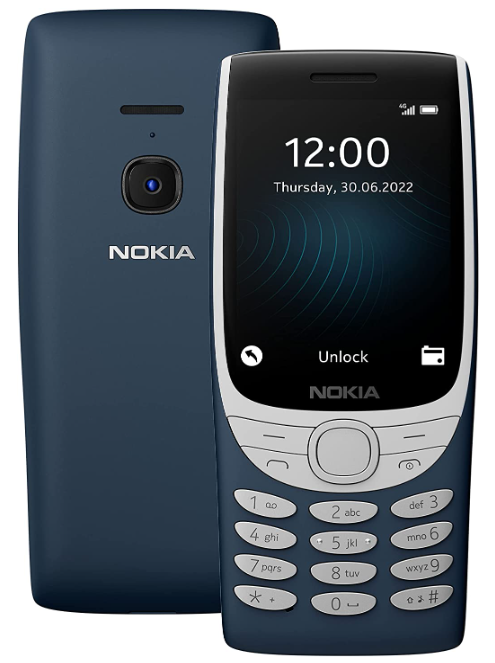

Americans also likely take our smartphones for granted. These contain unlimited internet, entertainment and information along with our ability to remotely purchase products or share money. The idea of an old Nokia phone would seem obsolete to most of us. However, Nokia has become ubiquitous in many underdeveloped regions of the world and this has not only increase people’s ability to communicate, but Nokia phones allow people to become banked. They have bank accounts through their phones. This includes conventional money as well as crypto. Because of this, unbankable people of the past now have access to banking which gives them an opportunity to enter the modern marketplace. They can take digital payments, and show transaction history and savings. All of these things create upward mobility.

Nokia is a Finnish telecommunications company that has a long and storied history in the mobile phone industry. While the company is perhaps best known for its iconic "brick" phones of the 1990s, Nokia has continued to innovate and evolve its products over the years. Today, Nokia phones are known for their reliability, durability, and affordability, making them popular choices for people in emerging markets and developing countries.

One area where Nokia phones have been particularly useful is in the realm of mobile banking. In many parts of the world, traditional banking services are not widely available or accessible, particularly in rural or remote areas. Mobile banking has emerged as a viable alternative, allowing people to access financial services and manage their money using their mobile phones.

Nokia phones have played a key role in this mobile banking revolution. Many Nokia phones are equipped with features such as mobile internet connectivity, SMS messaging, and mobile money platforms, making them ideal for accessing mobile banking services. Nokia phones are also known for their long battery life, which is particularly important in areas where access to electricity is limited.

In addition to their hardware capabilities, Nokia phones have also been used to deliver innovative mobile banking solutions. For example, Nokia partnered with the Indian government to launch a mobile banking platform called Aadhaar, which uses biometric authentication to verify users' identities and enable them to access financial services.

Overall, Nokia phones have helped to democratize access to financial services and promote financial inclusion in many parts of the world. By providing reliable and affordable mobile devices that are equipped with mobile banking capabilities, Nokia has helped to empower people to take control of their finances and improve their economic well-being. As mobile banking continues to grow in popularity, Nokia is likely to remain a key player in this important and rapidly evolving industry.