By Jerry Mooney

Image from: Pixabay

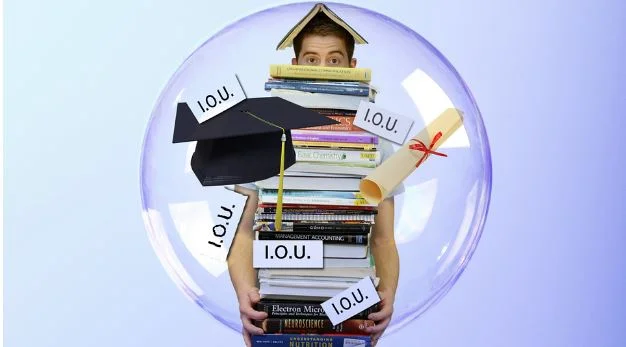

Attending college or university will often pay off in the long run as you get more lucrative career opportunities. But while you’re there, it can be hard to handle your financial situation. Your student loans can cover much of the cost of tuition. But you’ll also have to consider expenses such as your accommodation, school supplies, and general living costs.

Fortunately, there are many ways you can make your financial situation easier as a student. There are even some financial benefits to being in education. Here are some useful tips for managing your money while you’re in full-time education.

Consolidate Your Loans

Many students find themselves having to take out multiple loans to cover their expenses. Keeping up with numerous payments each month can be a hassle. The best way to handle your student loans is to merge them all into one.

There are many services available for student loan consolidation. It involves covering all your debts with one large loan, giving you a single easy-to-manage monthly payment.

Consolidating your loans can even make them cheaper. Plus, you won’t have to worry about forgetting one and dealing with higher payback costs. It’s an excellent idea for anyone having a tough time dealing with loans. If you want to learn more, going here would be a good starting point.

Get A Part-Time Job

Although a lot of your time outside of class will be spent studying, you should also consider getting a part-time job. Having an extra source of money can help you cover a lot of your costs and even treat yourself from time to time.

There are many student-friendly jobs for those in full-time education. A lot of restaurants and bars allow students to take casual shifts. This way, you can cut down on your hours when exams are coming up.

Many colleges also offer on-campus jobs for students. You may also want to consider retail, as many stores offer part-time or weekend work.

Use Discounts

No matter where you use your money, it’s always worth asking if you can get a student discount. Stores, restaurants, and other services often offer generous discounts for those in education. Always keep your student I.D. card handy just in case.

There are many popular companies which offer student discounts. Whether you’re looking for food, school supplies or electronics, make sure you get the best deal.

Make A Budget

There are many living costs you’ll have to deal with. Especially after you move out of student accommodation and into independent living. For many people, it’s the first time handling all these costs themselves. It’s best to make a weekly budget and avoid going into your overdraft.

Figure out how much you can afford to spend each week. Those with jobs will likely have more to spend. You might also get some money from parents. Set yourself a sensible limit to use each week.

Once you know how much you can spend, plan how you’re going to use it. You may want to plan out your weekly shopping list to keep it cheap. Consider necessities such as toiletries too. Don’t forget to have fun, though. Leave some money aside for going out and treating yourself.

Use Deal Hacks

Here is a link to Deal Hacks that can help you find helpful discounts.

Jerry Mooney is co-founder and managing editor of Zenruption and the author of History Yoghurt and the Moon. He studied at the University of Munich and Lewis and Clark College where he received his BA in International Affairs and West European Studies. He has recently taught Language and Communications at a small, private college and owned various businesses, including an investment company. Jerry is committed to zenrupting the forces that block social, political and economic justice. He can also be found on Twitter @JerryMooney