“You must spend money to make money.” -Titus Maccius Plautus.

The prime objective of every investment is to get high returns. However, the majority of the saving and investment options are subjected to taxes. As a result, the final return you get after deductions is relatively less than you may have expected.

It is noteworthy that you can not entirely avoid the payment of the tax levied. The IRS (Internal Revenue Service) is very smart and easily detects tax default. Fortunately, you can reduce the tax payable amount with proper research and planning. Additionally, you can elevate your returns by selecting your investment options wisely, such as opportunities offering tax advantages. Such opportunities are generally referred to as “Tax-efficient” investment options.

Let’s learn about these options in detail.

Municipal Bonds

Municipal bonds, also known as muni bonds, are issued by local governments. The government uses the money or funds to commence different projects like building schools or repairing roads. In return for the funds, you’ll get guaranteed interest payments. Not to mention, the federal tax exemption applies to these interest payments. That means you’ll get the exact amount of interest written in the bond.

However, municipal bonds have certain limitations or risks. For instance, inflation can affect the rate of interest. Some specific municipal bonds are subjected to AMT (Alternative Minimum Tax). Therefore, you must learn about the details of the bond you are interested in.

Self-Directed Individual Retirement Account (SDIRA)

IRA (Individual Retirement Account) is basically a savings account offering tax advantages. The investment in this account is made for long-term benefits. However, the assets you can invest in are restricted by IRS regulations.

If you wish to invest in a wide variety of alternative assets, it is suggested that you invest in a self-directed IRA (SDIRA). This account is usually administered by custodians but managed by the account holder (you). That’s why this account is known as self-directed. It is also a great option if you wish to add diversity to your tax-advantaged accounts.

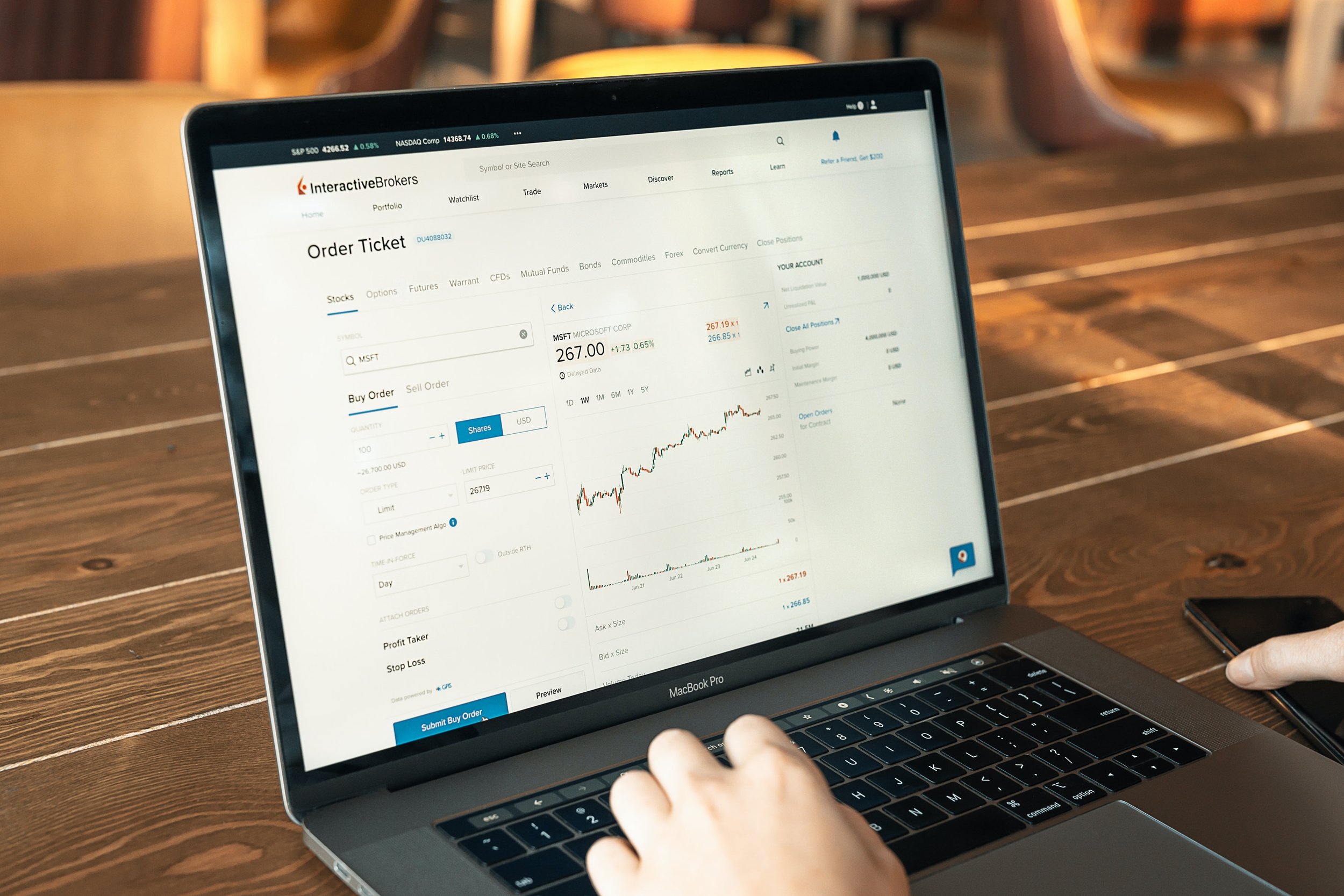

Tax-Exempt Exchange-Traded Funds (ETFs)

These funds are just like mutual funds except for the fact that they are traded at a stock exchange. Generally, exchange-traded funds follow a passive management style. In simple terms, the investor will track the market index on a regular basis instead of choosing securities to manage funds. By doing so, fund management costs are reduced to a great extent.

It is also noteworthy that ETFs can also be municipal bond-focused; thus, providing tax-exemption benefits. Depending on your goals and time horizon, you can invest in short, mid, and long-term tax-exempt bonds.

Similarly, there are tax-exempt mutual funds that offer hand-off investing. Nevertheless, it is wise to learn about the expenses and returns you’ll get. Do not make any financial decisions in a hurry; instead, take your time to learn about any risk associated and benefits available.

To Sum It All Up!

These are some tax-efficient investment options that you should deal with. It will ensure that you save more and pay less. Even so, it is suggested to take the help of a custodian before making the final decision.